Alaska offers residents and businesses clean energy incentives to install solar panels and invest in clean energy vehicles.

In combination with federal tax credits for green energy, the cost of any new equipment installed can qualify.**

TAX INCENTIVE NOTICE*

**Fraud Alert**

US Green Energy

Click Here to Sign Up for Free Solar Panel Installation

| Schedule | Acceptance Date | Last Day To Register |

|---|---|---|

| Q1 | Monday January 1, 2024 | March 30, 2024 |

| Q2 | Monday April 1, 2024 | June 30, 2024 |

| Q3 | Monday July 1, 2024 | September 30, 2024 |

| Q4 | Tuesday October 1, 2024 | December 30, 2024 |

| Q1 (2025) | Wednesday January 1, 2025 | March 30, 2025 |

Alaska Residential Energy Rebates

Energy Efficiency Rate Reduction

PLEASE NOTE: Beginning in 2025, the federal tax incentives for solar residential installation will be impacted. See the table below for the dates and amounts currently legislated.

**The Federal tax credit is available every year that new equipment is installed.

Alaska Government

120 4th St

Juneau, AK 99801

(907) 465-4648

Hours: M-F 8:00am – 5:00pm

Chugach Electric Association

5601 Electron Drive

Anchorage, AK 99518

(907) 563-7494

[email protected]

Hours: M-F 8:00am – 5:00pm

Alaska Energy Authority

813 W Northern Lights Blvd

Anchorage, AK 99503

Phone: (907) 771-3000

Fax: (907) 771-3044

Toll Free: (888) 300-8534

[email protected]

Hours: M-F 8:00am – 5:00pm

Juneau Weather Bureau

8500 Mendenhall Loop Road

Juneau, AK 99801

(907) 790-6800

[email protected]

Hours: Open daily, 24 hours

Clean Energy and Vehicle Federal Tax Credits

Business Federal Tax Credits

State Tax Credit and Rebate Schedule

| Year | Credit Percentage | Availability |

|---|---|---|

| 2024-2032 | 30% | Individuals who install equipment during the tax year |

| 2033 | 26% | Individuals who install equipment during the tax year |

| 2034 | 22% | Individuals who install equipment during the tax year |

| 2010- | Subject to local ordinances | Individuals who install renewable energy systems during the tax year |

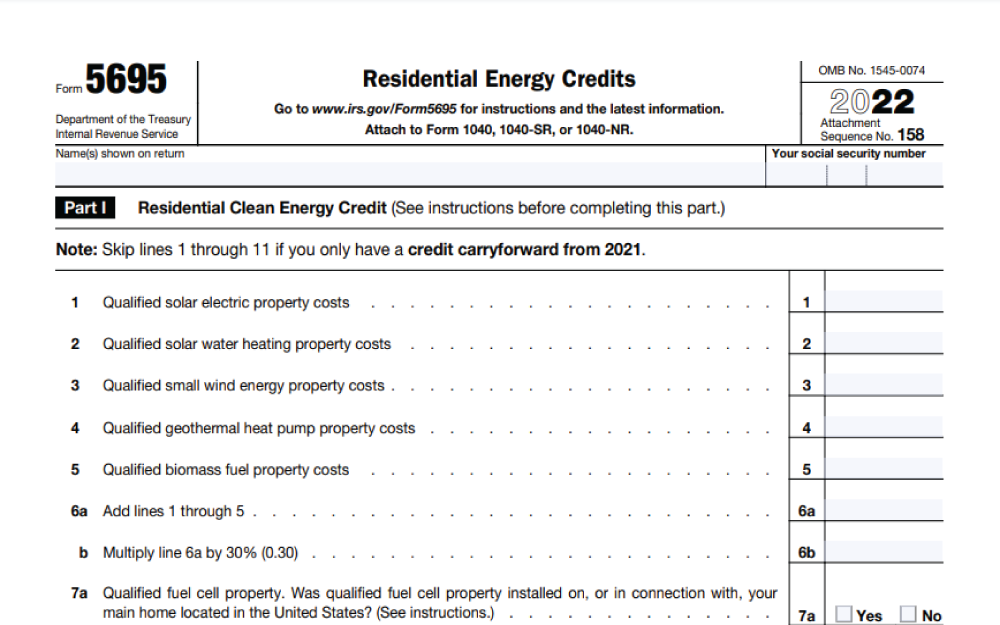

If you have determined that you are eligible for the green energy credit, complete Form 5695 and attach to your federal tax return (Form 1040 or Form 1040NR).

IRS Form 5695

Instructions

Future Due Dates and Basics

Office of Energy Efficiency & Renewable Energy

Forrestal Building

1000 Independence Avenue, SW

Washington, DC 20585

RESIDENTIAL CLEAN ENERGY TAX CREDIT

Alaska Clean Energy

Energy Efficiency Conservation

Renewable Energy Fund

Alaska Electric Vehicle Working Group

EV Fast-Charging Network

Solar Energy Basics

Solar for All

Solar Power Best Practices Guide

Contact

Alaska Energy Authority Programs

Maximize Savings With Alaska Solar Incentives

Alaska currently has over half of its renewable energy generated by solar panels and the state is making it attractive to increase that amount with home solar installations.

What’s more, there are federal solar incentives that have your back when it comes to financing a home solar system, and you can register for tax programs and rebates for free.

This guide outlines all the Alaska solar incentives available for residents and how you can get rebates and credits using open enrollment options right now.

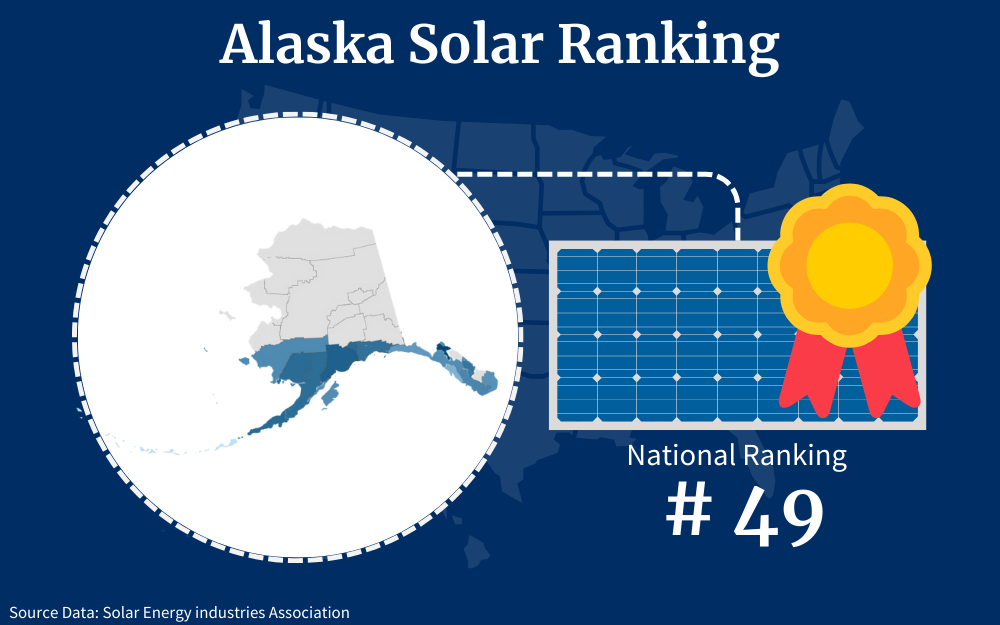

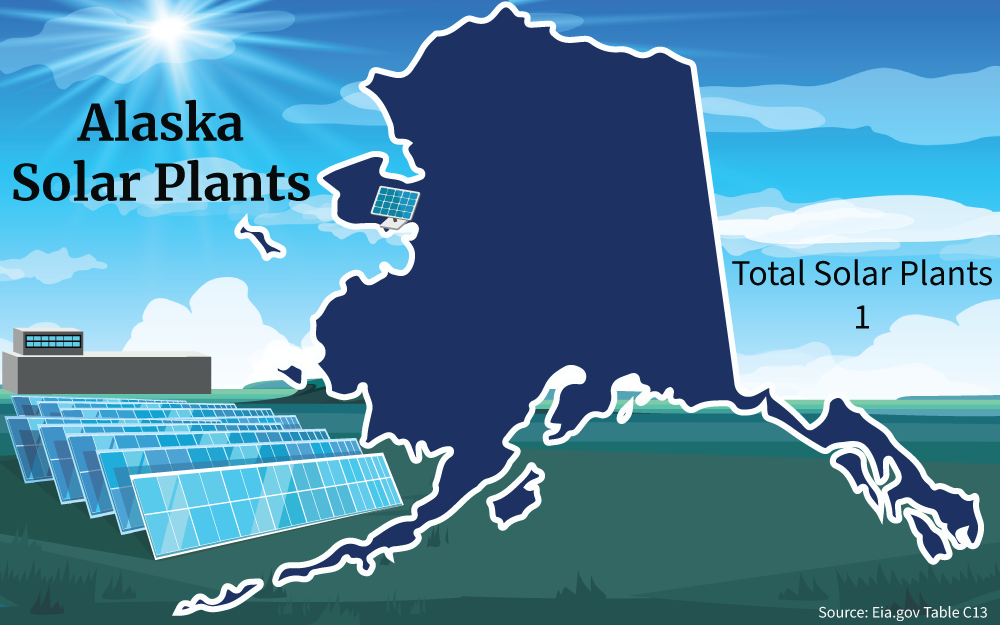

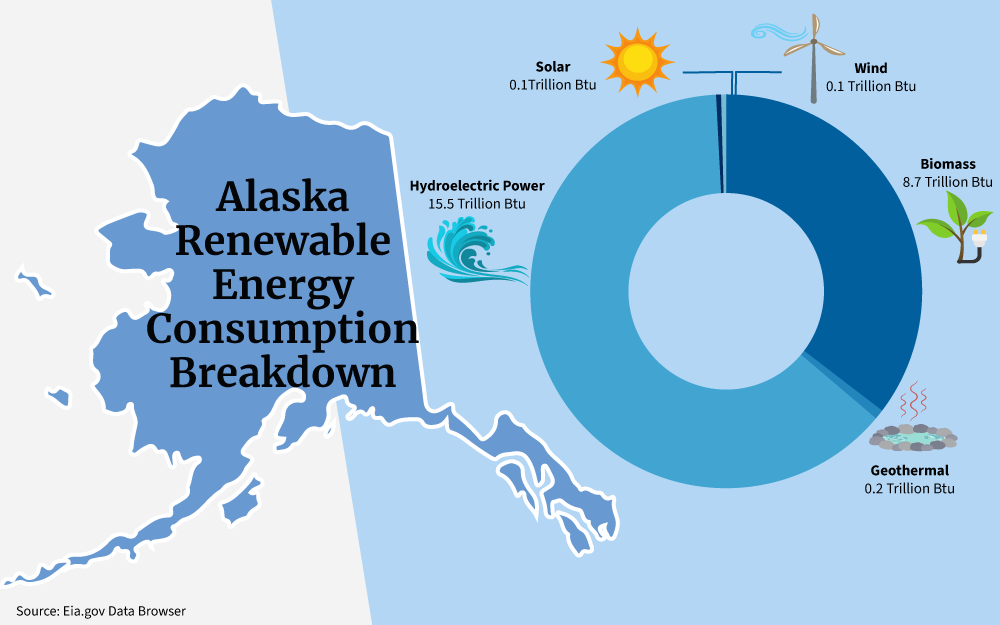

Currently, Alaska uses wind, biomass, geothermal, and solar renewable energy to power the state, with hydroelectric generation being the biggest provider. Solar is minimal, and the state ranks 49th in the nation for its adoption.

Increasing solar energy production in the state has presented some challenges, but it’s not impossible.

By providing online resources that allow residents to sign up for and receive solar tax credits, the shift can be accomplished, and residents can save money.

Moreover, solar energy can allow residents to completely disconnect from the grid, providing power options when grid energy is down.

Solar Panel Tax Credits in Alaska Explained

Are you worried that you may actually need a larger system and will have to dig deeper into your pockets? Well, you should know that the Alaska solar tax credit is more than willing to take some of that burden off your shoulders.

This tax credit is one of the government’s ways of promoting the use of renewable energy in the region.

That’s right. There is an incentive in place that helps make the acquisition of panels and the entire home solar installation process way easier. Anyone can enroll in these incentives.

The Federal Solar Tax Credit in Alaska: How ITC Works

In Alaska, like all 50 states, taxpayers may utilize the federal solar tax credit. Understanding how solar tax credits works can be beneficial, as they can decrease the overall cost of your home solar system by 30 percent.

That is why the renamed federal solar investment tax credit (ITC) is welcome news by the residents because there is no other incentive that is that lucrative.10

The Federal Tax Credit for Solar Photovoltaics works by deducting 30% of the installation and materials cost from the total amount of taxes that you owe.4

Say you paid the average amount of $14,400 for your system, then that means that your credit value will be nothing short of $4,000.

Even though Alaska doesn’t have specific solar incentives by state, like a statewide solar tax, this incentive can reduce your tax liability, and even covers some things that are required for the system, such as mounting equipment and other materials.

How Do You Qualify for the Solar Tax Credit?

As much as the federal solar tax credit is an attractive incentive, there are some people that miss out on it due to several reasons. This explains why it is necessary to understand the rules first before you bank on it.

- You have to complete the installation process first.

Many don’t know this, but you have to complete the entire installation process first before you are able to apply for the incentive. It only makes sense because how else will the 30% be calculated?

- You must be a taxpayer and have a tax liability.

Just from the name, you can tell that the credit is created as a tax relief. So, you must be a taxpayer and have a tax liability in the year of application.

- You must be the owner of the solar system.

The entire system and everything concerning it must all be under your name. You cannot get this credit on someone else’s equipment or a second-hand product, which also means that you are automatically out of the list if you have a solar leasing contract because the company is the rightful owner.

- The total amount of our tax liability also matters.

If your tax liability is less than the 30% that you used for installation, the balance easily carries forward to the next year and for a maximum of about 5 years. So, what are the individual limits on the federal solar tax credit?

Luckily enough, there are no limits. No matter how much the system costs or how much your tax liability is, it will still be 30% off.

What Forms Do I Need To Fill Out To Get the Credit?

Now that you know exactly how the federal solar tax credit works, the next part is to learn what forms do I need for solar tax credit? It is indeed a game changer when it comes to determining how much do solar panels cost, but you still have to know how to apply for it and the necessary requirements.

The great news is that the application process is not even complicated and will likely take you just a few minutes.

Step 1: Make sure that all the criteria are met

You don’t want to miss out on the incentives due to not following the rules. You have to make sure that you are eligible for the tax credit, that you have completed the installation, and that you are the rightful owner of the solar system.

Step 2: Print out and follow the form 5695 instructions

When you are filing your taxes, you will have to print out the IRS form 5695,7 which is basically you disclosing all the details about the installation.

It is unlike the solar tax credit form 3468,11 which solely deals with investment tax credits for businesses. This one is purely for solar tax credit reasons; it will not take you that long to get it done, but if you are uncertain, you can always consult an expert.

Step 3: Make sure that the federal solar tax credit form is accurately filled

You may realize that you will have to contact your solar installer for some details about the project. It is also crucial to have some other documents with you for more information, like the forms you filled with the company.

These documents will outline some details like the size of the system and exactly how much it costs.

Step 4: File the form with your taxes

When all the above steps are done, the last thing that you have to do is to file the solar tax credit forms Alaska together with your taxes. Here is where you send the documents over to the IRS for them to review and check whether you are eligible for the tax credit or not.

Solar Stimulus Program: Government Solar Panel Program Options

Truthfully, Alaska doesn’t have too much going on when it comes to solar incentives, but still, you are lucky because there are solar stimulus packages being offered by various local companies. Apart from the solar tax credit that does the most, you can also save more by applying for the following solar incentives in your area.

Sustainable Natural Alternative Power Program From GVEA

The Golden Valley Electric Association customers have a reason to smile because the utility company has something in store for them.12

You will be able to receive about $1.50 for each and every kWh that your solar system generates. This is as long as you have a 25 kW system or smaller, which is virtually any residential solar installation in Alaska.

AP&T Program: EV Rebate

Another piece of great news for Alaskans, particularly the customers of Alaska Power and Telephone.13

Did you know that you can receive as much as $1,000 just for buying an electric vehicle?1

Chugach Electric Vehicle Charger Program

Although this is not exactly a solar panel initiative, it is also a boost if you are using energy-efficient systems.14

You can receive around $200 as long as you have installed a level-2 electric vehicle charger.

Alaska Housing Finance Corporation: New Energy Efficient Home Rebate

In addition to the other Alaska solar incentives, one rebate plan is designed to spur green energy construction.

Based on the home energy rating index, homeowners can apply for up to $10,000 in cash from the Alaska Housing Finance Corporation.

The conditions include:

- It must be the primary residence of the person who applies

- The construction must be less than one year old

To apply, contact the AK Rebate Call Center at 877-257-3228.

Solar Power in Alaska

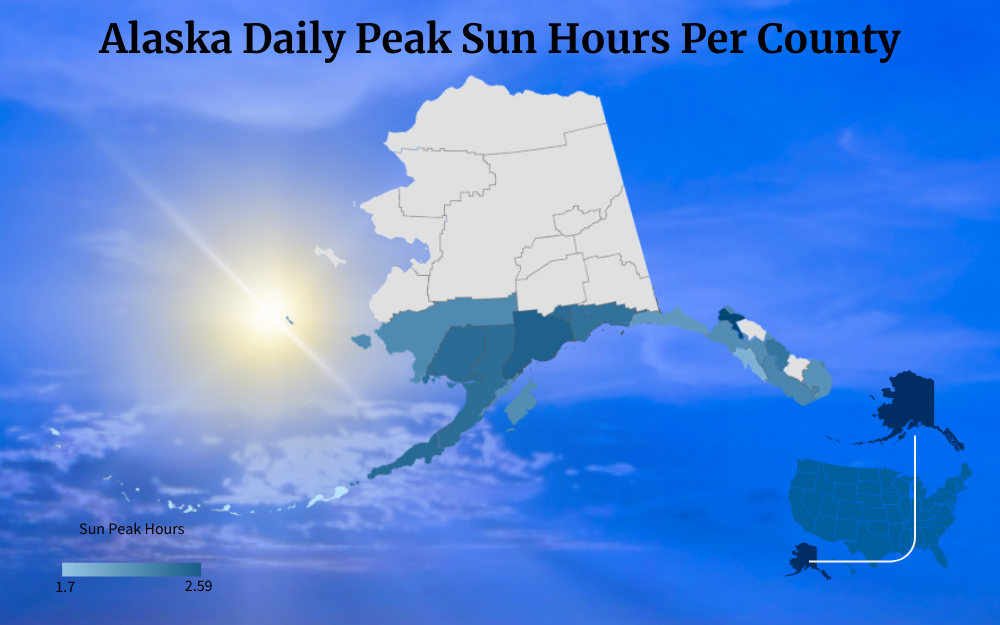

As of the year 2022, solar Alaska came in at number 49 in the entire nation. That is understandable, especially considering the geography of the region.

While 121 days on average doesn’t even come close to the national tally of 205, which kind of holds back the rate of solar panel installation Alaska.

Makes you wonder, do solar panels work in Alaska?

Apart from that, the solar energy facts in Alaska are pretty fascinating. The current installation capacity can only power up just about 2,000 homes, but that doesn’t maximize the potential of solar power, especially considering the high energy needs of the residents.2

One more thing that seems to get in the way of solar adoption in the state, or in any other place for that matter, is the cost of solar panels in Alaska.

But not to worry about that because there are Alaska government solar incentives set up to ensure that the conversion doesn’t cost you a fortune. The Alaska solar incentives like the tax credit are perfect examples of how government solar programs can turn things around.

What Materials and Parts Do You Need for Solar Panel Systems?

Solar usage has grown in Alaska over the last decade and more and more homeowners are making the switch to this renewable and cleaner energy.

You may be thinking about going solar but first things first, you should be able to know what that means and what you need to get the project up and running. You must be aware of the PV panel, of course, but the system is more elaborate than that.

There are more pieces of solar equipment that you as a homeowner have to buy before you can confidently say that you have set up a solar system.9

What Do You Need for a Solar Panel System?

- Solar panel: This is also more commonly known as the PV cell and is actually the backbone of the entire system; without it, nothing will ever work. There are so many brands to choose from in Alaska, but the monocrystalline panels are the most efficient and, of course, the most expensive of the bunch.

- Inverter: Here is where the voltage that comes from the system is converted from DC to AC, which is now what your household appliances use to run. There are like three types in the market, micro inverter, power optimizer, and string inverter.

- Controller: This is another crucial component of the system because it is basically the device that regulates just how much voltage comes from the panels. It prevents the system from overcharging and damaging other parts in the process.

- Battery: This is the backup, in other words. It is the equipment that holds the surplus power that comes from your solar system allowing you to have electricity even at night or when there is no sun, which you already know is very vital if you are living in Alaska.

What Is the Cost of Installing Solar Panels in Alaska?

Now onto the most important and most pressing question from first-time solar panel owners, what is the cost of going solar in Alaska? Say that you need a 6 kW system for your house, you will end up parting with about $14,400, which basically means that the $2.41 a watt is lower than that of the national average of $2.66 a watt.

It goes without saying that the average cost for installing solar panels in Alaska is cheaper than in other states but also remember that the rate is usually valued based on individual needs. You may even pay less if you have lower energy needs or if you go for cheaper panels.

How Can I Sell Power to Alaska?

One common question is, how long are solar panels good for? The solar panel life can stretch to as much as 25 years, which gives you more than enough time to maximize them.

In all those years, you won’t have to worry about paying hefty electric bills every single month, and you can do the math to find out how much money you will save over the course of panels working.

Running your home is not all that the system can do. Did you know that you can also ‘sell’ power to the grid?

This is simply called net metering, where you are able to send over the excess power that comes from your solar system to make it a sort of solar grid; this way, you can also get the credit that goes to reducing or offsetting your energy bills.

You know how crucial this is in Alaska, given that the electricity rate is nearly double that of the national average. It is a good thing, then, that the Regulatory Commission of Alaska makes sure that the retail rate is favorable for customers.8

So, how are you able to enroll for net metering in Alaska?

First and foremost, you will have to consult with your solar installer to confirm that you have the type of meter that will allow NEM. If yours is not the bidirectional one, then they should easily provide one.

It will come as a relief that the most reputable companies will not really mind handling the entire application process for you. You should also check that your credits are counting as they should, and probably the best way to confirm this is by verifying your utility bills.

Using Photovoltaic Cells in Alaska for the Solar Grid

If the report from the SEIA is anything to go by, there are only a handful of solar companies operating in Alaska. But even so, you still have to be very careful when choosing who will handle the entire project for you.

Solar panels renewable energy is supposed to serve you for more than two decades, but that can only happen if you get the best products and equally excellent service.

Unless you are installing solar panels DIY, you need to be very keen on the selection. If you are choosing your solar service provider, you are going to have to take some factors into consideration.

- Do the company’s products have a warranty?

Like any other product out there, you can easily tell the level of durability of the solar system by checking whether the warranty is extended.5 This basically means that the company is sure that it has the most durable and effective materials.

- Check the ratings

There is pretty much one simple way to verify a company, and that is by checking what its customers have to say about it. You are going to check for the best rates installers and the ones that come highly recommended by your friends and neighbors.

- Is the contractor licensed?

The last thing that you want to do is to hire an unlicensed contractor. You should be able to confirm that you are dealing with an experienced professional by checking whether they at least have a NABCEP certification.

How To Use a Solar Savings Calculator

As any other prospective solar system owner, you are already thinking about exactly how much money you are going to save by making the switch. Apart from that, you may also be considering how much power your system is supposed to generate and maybe how many panels you will need to get the job done.

What if you learned that you don’t have to make tedious calculations to get these values and that there are automatic systems that can help you figure out these numbers? For instance, there is the residential solar power calculator or the solar panel production calculator that basically tells you how much power you can actually expect your system to produce.

There is a simple algorithm behind this, really. The system usually takes the power rating of the panels, multiplies it by the total number of hours of sunlight on a daily basis, then multiplies the result by 0.75.3

As for the savings that you are going to make, the system first takes into account the amount of power that the system generates, how much you tend to spend on power every month, the nature of your roof, your location, and other prevailing conditions.

The best calculators usually give you the payback period of the solar panels and the total amount that you are going to save throughout the life of your system.

Is Solar Worth It in Alaska? Daily Sunlight Hours

If you come to think about it, there are so many benefits of going solar in Alaska.6 Any solar user will tell you about how much savings they have really made over the years by cutting ties with the grid and generating their own power, from their own roofs, all thanks to their solar panels USA.

On the other hand, those who are eco-conscious will also attest to the fact that switching to renewable energy is one of the initial steps to reducing individual and household carbon footprints.

Therefore, as much as you may be worried about the fewer sunny days in Alaska, you cannot ignore the above advantages. Besides, given that there are atrociously high energy bills in the state, going solar makes all the more sense for you as a homeowner.

You cannot dismiss the fact that converting to solar is worth every single penny. However, there may be one problem that you have to look into, the negative effects of solar panels.

Even though there are so many praises surrounding solar panels, there is an issue with improper disposal of solar panels and the impact of solar energy on environment in the long run. That is why the government is advocating for the recycling of Alaska solar panels when they exhaust their service.

Luckily, there are various recycling companies around that will gladly take your old panels off your hands.

It is pretty fascinating that Alaska has solar potential, even though it is maybe one of the last places that you could think of when you are considering high solar ranking. Despite the few sunny days and less average sunlight hours in a single day, you can still be a proud solar system owner.

It doesn’t always take from the fact that there are still sky-high energy bills and high energy needs. Solar power is the ultimate solution when you are looking for a way out of expensive utility bills. It also doesn’t hurt knowing that solar is cleaner for the environment than fossil fuels.

If the reason for holding back is the fear that solar power is too expensive, you will be excited to find out that there is a federal solar tax credit that reduces up to 30% of the whole cost.

The application process is also pretty straightforward and will take you a matter of minutes.

As long as you have met all the criteria for application, you should be able to receive the solar incentive and notice how much the cost of solar panels in Alaska drops.

Understanding Alaska solar incentives can help you make an informed decision about purchasing and installing solar panels in your home.

Frequently Asked Questions About Alaska Solar Incentives

Is Solar Power a Good Idea in Alaska?

Regardless of the fewer sunny days that are practically half that of the national average, going solar in Alaska is still worth considering. Not only is it a perfect way to save you a lot of money that you would have otherwise used to pay hefty energy bills, but it is also kinder to the environment simply because it emits no harmful greenhouse gases and helps you reduce your carbon footprint.

Is There a Statewide Solar Tax Credit in Alaska?

Sadly, Alaska currently doesn’t have a specific statewide solar tax credit. The only one that is in effect is the federal solar tax credit, which is still a great way to save a lot of money on your installation cost.

Are There Free Panels in Alaska?

Unfortunately, Alaska doesn’t seem to have such a program for its residents. However, solar leasing comes pretty close because you get to have the panels installed at little or no cost, and you only have to pay a small fee at the end of the month.

References

1Alaska Solar Rebates And Incentives. (2023). Clean Energy Authority. Retrieved August 20, 2023, from <https://www.cleanenergyauthority.com/solar-rebates-and-incentives/Alaska>

2Freitas, T. (2023, July 4). Alaska Solar Incentives | 2023 Cost and Savings. SaveOnEnergy.com. Retrieved August 20, 2023, from <https://www.saveonenergy.com/solar-energy/Alaska/>

3How To Calculate Solar Panel Output. (2023, June 16). EcoFlow Blog. Retrieved August 20, 2023, from <https://blog.ecoflow.com/us/how-to-calculate-solar-panel-output/>

4Simms, D. (2023, July 18). 2023 Alaska Solar Tax Credits, Rebates & Other Incentives. EcoWatch. Retrieved August 20, 2023, from <https://www.ecowatch.com/solar/incentives/ak>

5Watt, K. (2023, April 22). Going Solar in Alaska? Here’s How to Know if It’s Worth It. CNET. Retrieved August 20, 2023, from <https://www.cnet.com/home/energy-and-utilities/Alaska-solar-panels/>

6Petersen, K. (2019, February 6). Can Solar Work in Alaska? Hughes Village Says Yes. Office of Indian Energy Policy and Programs. Retrieved August 31, 2023, from <https://www.energy.gov/indianenergy/articles/can-solar-work-alaska-hughes-village-says-yes>

7Internal Revenue Service. (2023). About Form 5695, Residential Energy Credits. Internal Revenue Service. Retrieved August 31, 2023, from <https://www.irs.gov/forms-pubs/about-form-5695>

8Regulatory Commission of Alaska. (2023). About the RCA. Regulatory Commission of Alaska. Retrieved August 31, 2023, from <https://rca.alaska.gov/RCAWeb/AboutRCA/AboutTheRCA.aspx>

9Solar Energy Technologies Office. (2023). Homeowner’s Guide to Going Solar. Office Of Energy Efficiency & Renewable Energy. Retrieved August 31, 2023, from <https://www.energy.gov/eere/solar/homeowners-guide-going-solar>

10Solar Energy Technologies Office. (2023, March). Homeowner’s Guide to the Federal Tax Credit for Solar Photovoltaics. Office Of Energy Efficiency & Renewable Energy. Retrieved August 31, 2023, from <https://www.energy.gov/eere/solar/homeowners-guide-federal-tax-credit-solar-photovoltaics>

11Internal Revenue Service. (2023). Form 3468 Investment Credit. IRS. Retrieved September 13, 2023, from <https://www.irs.gov/pub/irs-pdf/f3468.pdf>

12Golden Valley Electric Association. (2023). Programs/Services. GVEA. Retrieved September 13, 2023, from <https://www.gvea.com/services/programs-services/>

13Alaska Power & Telephone Company. (2023). Alaska Power & Telephone Company Website Homepage. AP&T. Retrieved September 13, 2023, from <https://www.aptalaska.com/>

14Chugach Electric Association, Inc. (2023). Residential EV Charging Program. Chugach Electric Association, Inc. Retrieved September 13, 2023, from <https://www.chugachelectric.com/energy-solutions/electric-vehicles/residential-ev-charging-program>

15Screenshot of IRS Form 5695. Internal Revenue Service. Retrieved from <https://www.irs.gov/pub/irs-pdf/f5695.pdf>

16Photo by pasja1000. Pixabay. Retrieved from <https://pixabay.com/photos/the-roof-of-the-house-the-window-3257327/>